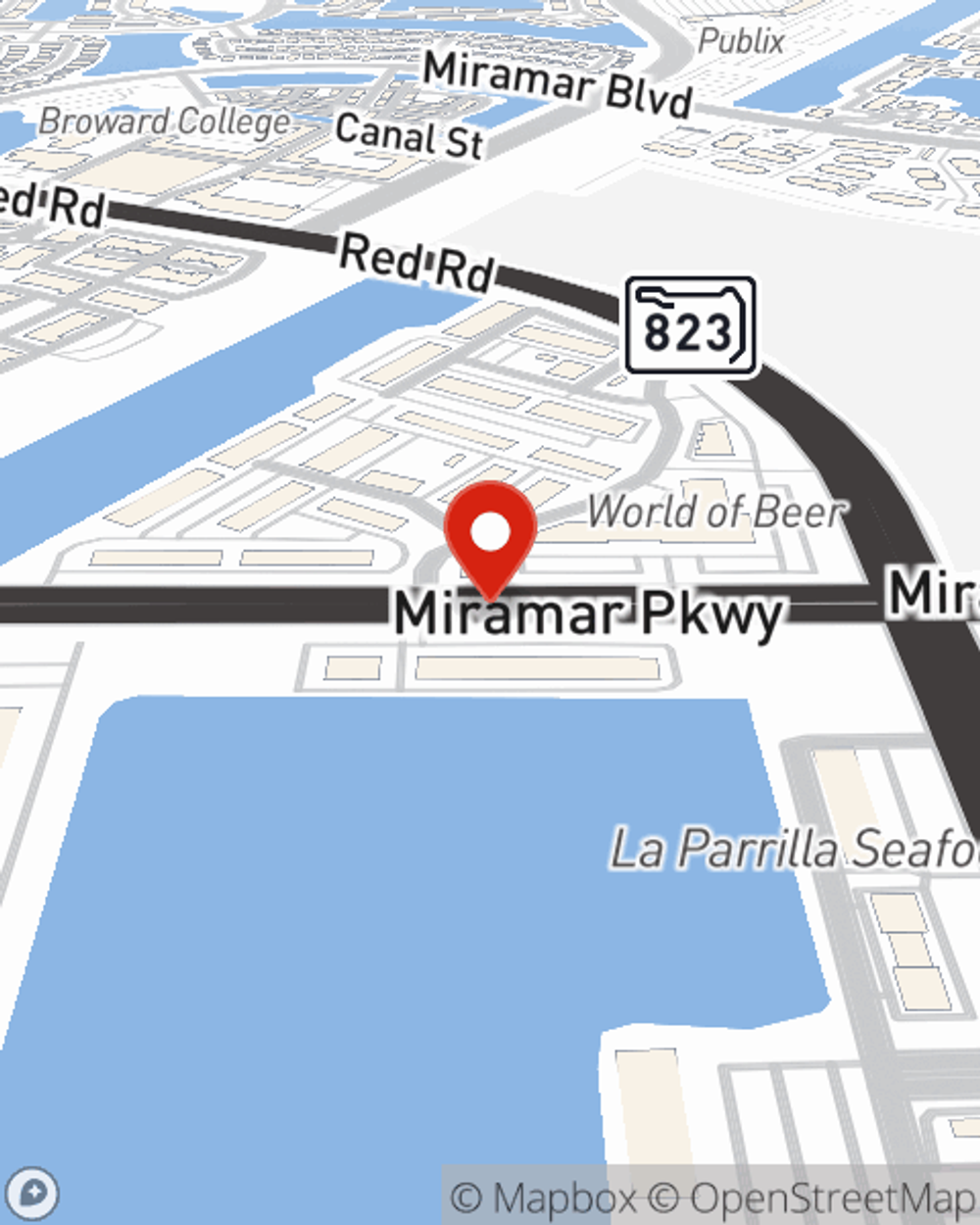

Insurance in and around Miramar

Need insurance? We got you.

Protect what matters most

Would you like to create a personalized quote?

Personal Price Plans To Fit Your Needs

State Farm understands the need to protect what's important to you and has developed an extended range of insurance products with personalized pricing plans to help protect what you've built. From vehicle and motorcycle insurance that protects your ride, to your boat, motorhome, RV, and off-road ATV, State Farm has competitive prices and easy claims to help you protect them all. Contact Ava Stewart for a Personalized Price Plan.

Need insurance? We got you.

Protect what matters most

Insurance Products To Meet Your Ever Changing Needs

But your automobile is just one of the many insurance products where State Farm and Ava Stewart can help. House, condo, or apartment, if it’s your home, it deserves State Farm protection. And for the unexpected. Securing your family’s financial future can be a major concern. Let us ease that burden. With a range of products, cost structures, and unmatched financial strength, State Farm Life Insurance is a smart choice and a great value.

Simple Insights®

Internet safety tips for teens

Internet safety tips for teens

Between identity theft, cyberbullying, stalking, and phishing scams, steer your teen away from Internet dangers with this guide to online safety.

Ways to prevent package theft at your home

Ways to prevent package theft at your home

With more people shopping online for efficiency & convenience, package theft is a serious concern. Discover how to plan for deliveries & secure purchases.

Ava Stewart

State Farm® Insurance AgentSimple Insights®

Internet safety tips for teens

Internet safety tips for teens

Between identity theft, cyberbullying, stalking, and phishing scams, steer your teen away from Internet dangers with this guide to online safety.

Ways to prevent package theft at your home

Ways to prevent package theft at your home

With more people shopping online for efficiency & convenience, package theft is a serious concern. Discover how to plan for deliveries & secure purchases.